michigan sales tax exemption industrial processing

To provide for the ascertainment. These tax-exempt energy resources that are consumed may be a component of the product being manufactured used directly to operate certain machinery and equipment or used for incidental activities such as.

Michigan provides an extensive sales tax exemption for manufacturers involved in industrial processing.

. The industrial processing exemption is limited to specific property and activities. Property used in both exempt industrial processing activities and in non-exempt activities qualifies for the exemption for the portion of the cost attributable to the exempt use. The dies are exempt because they are used by an industrial processor Subsidiary Corp in an industrial processing activity.

It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Sale or Rentals Outside the State of Michigan. The Michigan Supreme Court held that sales of container bottle and can recycling machines and repair parts qualify for the states sales and use tax exemption on machinery used in industrial processing.

The State of Michigan allows an industrial processing IP exemption from sales and use tax. Michigan offers an exemption from state sales tax on the purchase of electricity natural gas and water used in qualifying production activities. Sales of food intended for immediate consumption including coffee and snack items are subject to sales tax except in the following situations.

Certain property that can be include the following statement. Industrial Processors An industrial processing exemption is allowed for property which is used or consumed in transforming altering or modifying tangible personal property by changing the form composition or character of the property for ultimate sale at retail or for sale to another processor for further processing and ultimate sale at retail. Michigan defines industrial processing as the activity of converting or conditioning tangible personal property by changing the form composition quality combination or character of property for ultimate sale at retail or for use in the manufacturing of a product.

All claims are subject to audit. Michigan Department of Treasury Tax Compliance Bureau June 2015 Page 7 of 96. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim.

Energy such as natural gas electricity and propane used directly in the manufacturing process is exempt from sales tax. The Michigan Department of Treasury DOT had argued that the tasks the container-recycling machines perform occur before the industrial process. 1 The sale of tangible personal property to the following after March 30 1999 subject to subsection 2 is exempt from the tax under this act.

Michigan bills HB. With the exemption claim the purchaser must grain drying equipment. A An industrial processor for use or consumption in industrial processing.

Liable for sales or use tax on the purchase of the dies delivered to it in Michigan. The GSTA and UTA generally define industrial processing as the activity of converting or conditioning tangible personal property by changing the form. GENERAL SALES TAX ACT Act 167 of 1933 AN ACT to provide for the raising of additional public revenue by prescribing certain specific taxes fees and charges to be paid to the state for the privilege of engaging in certain business activities.

This tax exemption is authorized by MCL 20554t 1 a. 4225 exempt businesses which might not be eligible for industrial processing exemption covering purchases of protective gear and will help businesses buy certain. To provide incident to the enforcement thereof for the issuance of licenses to engage in such occupations.

Students buying meals from University. The Michigan Department of Treasury unsuccessfully argued that the machines may not qualify for. Sales or Rentals for Agricultural Production.

Manufacturers and industrial processors with facilities located in Michigan may be eligible for a utility tax exemption. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. For example a forklift truck that moves in-process parts for 60 percent of the time and is usedin shipping and receiving for the remaning 40 of the time would qualify for a 60 industrial.

The Michigan sales and use tax exemptions for both the agricultural industry and the industrial processing or manufacturing industry include such language. Authorized to pay use tax. Industrial Processing Tax Exemption.

The Michigan Department of Treasury DOT had argued that the. The Michigan Supreme Court held that sales of bottle and can recycling machines that help retailers comply with Michigans bottle-deposit law may qualify for the states sales and use tax exemption applicable to machinery used in an industrial-processing activity. Structural part of real estate unless it is agricultural land purchasers that claimed direct pay exemption from sales tile subsurface irrigation pipe a portable grain bin or and use taxes.

Sales or Rentals for Industrial Processing or for Resale.

Michigan Sales Tax Exemption For Manufacturing

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales And Use Tax Certificate Of Exemption

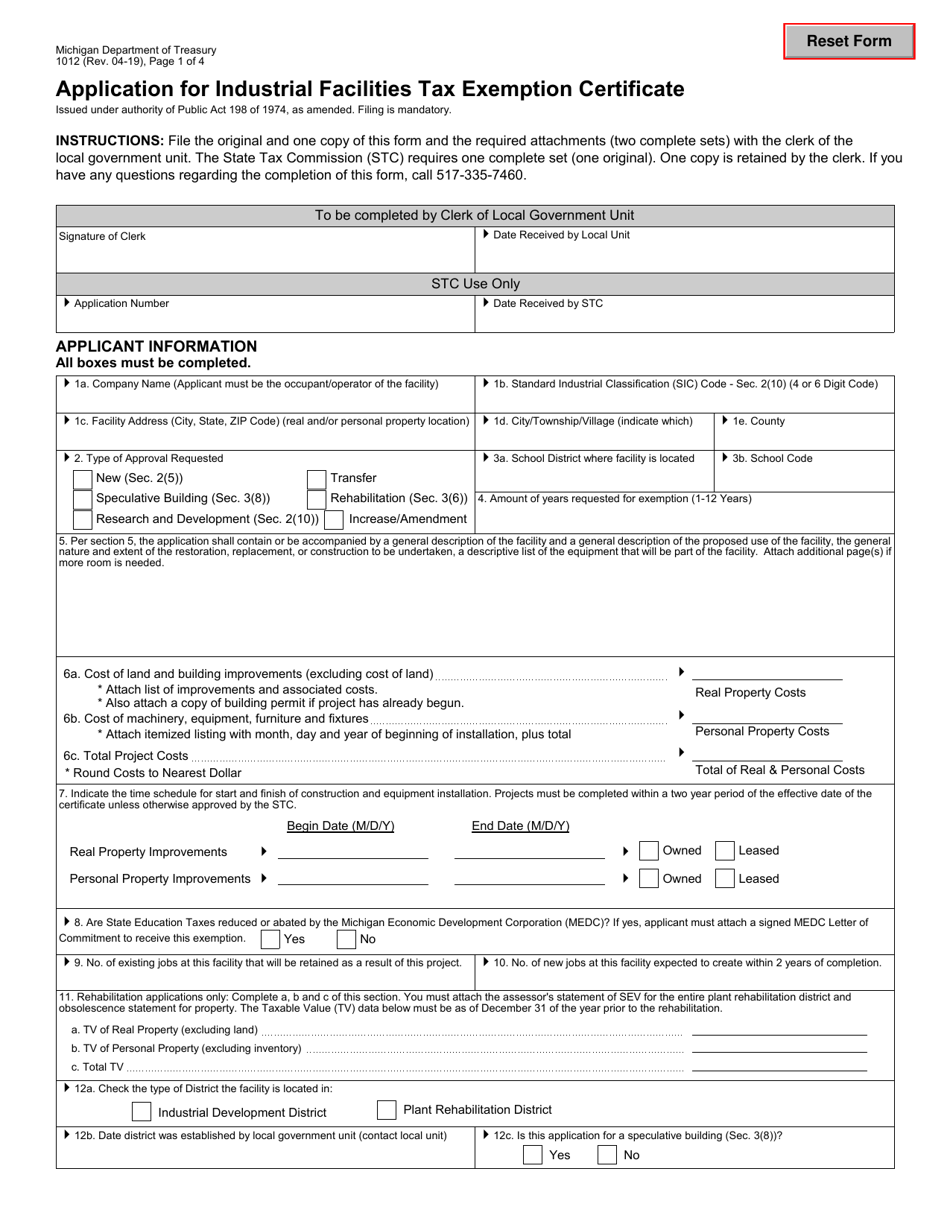

Form 1012 L 4380 Download Fillable Pdf Or Fill Online Application For Industrial Facilities Tax Exemption Certificate Michigan Templateroller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller

Michigan Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller

Michigan Sales Tax Exemption For Manufacturing

Michigan Sales Tax Exemption For Manufacturing

Form 3372 Download Fillable Pdf Or Fill Online Michigan Sales And Use Tax Certificate Of Exemption Michigan Templateroller