utah state food tax

2022 Utah state sales tax. Like lotteries state taxes on.

Sales Tax On Grocery Items Taxjar

Lesser said the debate around whether Utah should repeal its state sales tax on food has been ongoing between state leaders for almost four decades now.

. The restaurant tax applies to all food sales both prepared food and grocery food. But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong. The tax reform package would increase the states portion of the sales tax on food from 175 to 485.

All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. She argued it would be. 85 tax on prepared foods like what you get in a restaurant.

There are only 13 states which tax food at any rate while 37 states have no sales tax on food at all. Both food and food ingredients will be taxed at a reduced rate of 175. It disproportionately hurts low-income Utahns and.

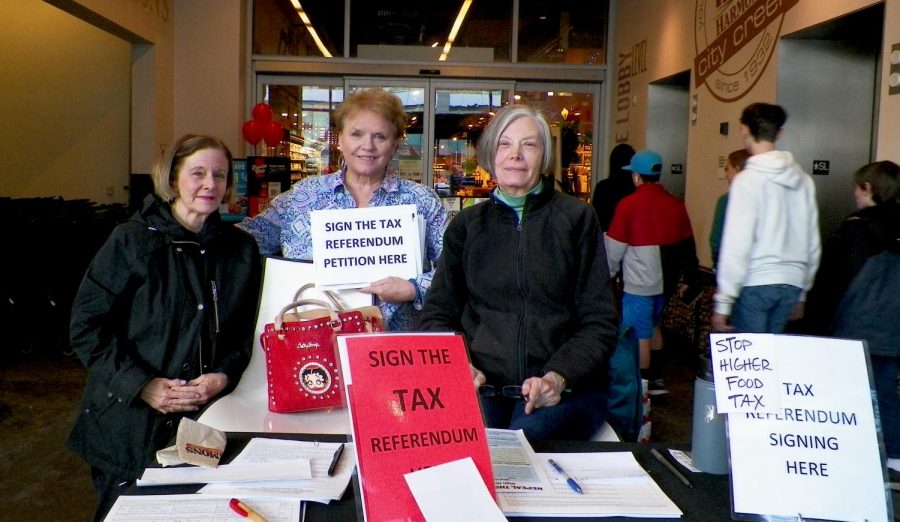

These transactions are also subject to local option and county. 75 tax on unprepared foods like what you would buy in. Rohner led a referendum effort to stop the 2019 Utah Legislature tax reform package which would have created a 31 increase on the state sales tax on groceries a.

However in a bundled transaction which. Utah ABC4 Utah legislators are considering putting an end to state food taxes once and for all. Utah just passed a tax reform bill that raised the food tax from its current 175 to 485.

You are able to use our Utah State Tax Calculator to calculate your total tax costs in the tax year 202223. In the state of Utah the foods are subject to local taxes. UTAHS FOOD TAX.

Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer. Many lawmakers have been itching to do this for years virtually ever. Department of Agriculture low-income families spend 36 of their income on food compared to 8 for high-income families.

File electronically using Taxpayer Access Point at. On Tuesday Utah State Rep. Both food and food ingredients will be taxed at a reduced rate of 175.

Advocates for the poor argued this increase would disproportionately fall on low-income. Exact tax amount may vary for different items. Judy Weeks Rohner and activists have gathered.

Currently food is taxed in two ways. In the state of Utah the foods are subject to local taxes. According to the US.

The state of Utah currently taxes food at a rate of 175. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. The repeal of the states 175 food tax emerged as an issue in the 2022 session pushed by Lesser and the candidates sounded off on the topic.

Utahns experiencing food insecurity and hunger advocates have been vocal about their opposition to the increase which would raise the food tax from 175 to 485 percent. Our calculator has recently been updated to include both the latest Federal Tax Rates. However in a bundled transaction which.

Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales tax rate of 175.

Rusty Cannon Eliminating Utah S Sales Tax On Food Is A Bad Idea

Sales Tax Laws By State Ultimate Guide For Business Owners

Goodbye Tampon Tax At Least For Some The New York Times

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

These Are Some Of The Most Popular Foods In Utah

Utah County Passes Quarter Cent Sales Tax Kjzz

Census Bureau Releases State Tax Collection Data For 2010

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

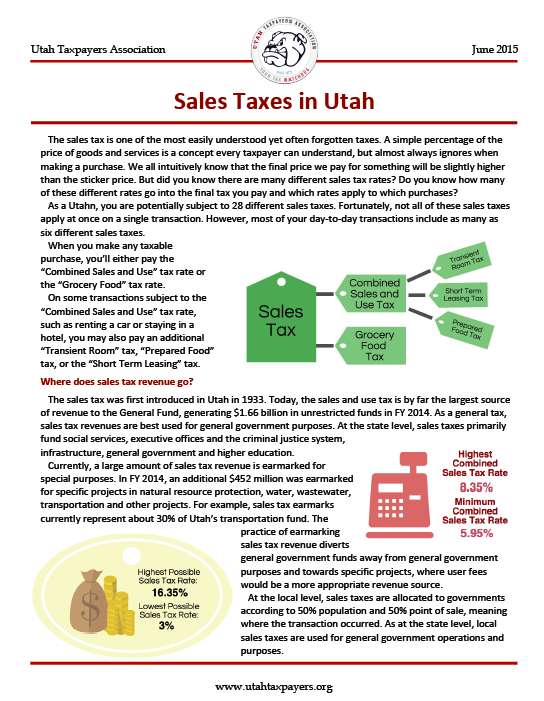

Sales Taxes In Utah A New Report From The Utah Taxpayers Association Utah Taxpayers

State Legislators Discuss Raising Utah S Sales Tax On Food From 1 75 To Nearly 5 Kutv

Barron Referendum Efforts Send A Signal To State Representatives The Daily Utah Chronicle

State Legislators Discuss Raising Utah S Sales Tax On Food From 1 75 To Nearly 5 Kutv

Tc 62ag Utah State Tax Commission Utah Gov